Bulk-generate & schedule posts in seconds with Smart Scheduling. Try now!

Best competitive intelligence tools & trends for 2025

In today’s hyper-competitive market, staying one step ahead isn’t just advantageous—it’s essential. That’s why 90% of Fortune 500 companies now utilize competitive intelligence (CI) to inform their strategic decisions. These powerful tools have transformed from basic information gathering into sophisticated systems that reveal the complete competitive picture.

Modern CI platforms don’t just collect data—they connect dots across competitors, markets, and customers that human analysis might miss. They detect early warning signals of market disruption, illuminate blind spots in your strategy, and spotlight opportunities that others haven’t yet recognized.

The journey from the 1980s’ manual competitive analysis to today’s AI-powered intelligence platforms reflects the growing importance of market awareness. What once required teams of analysts to pore over industry reports now happens automatically, delivering insights directly to decision-makers’ fingertips through real-time dashboards.

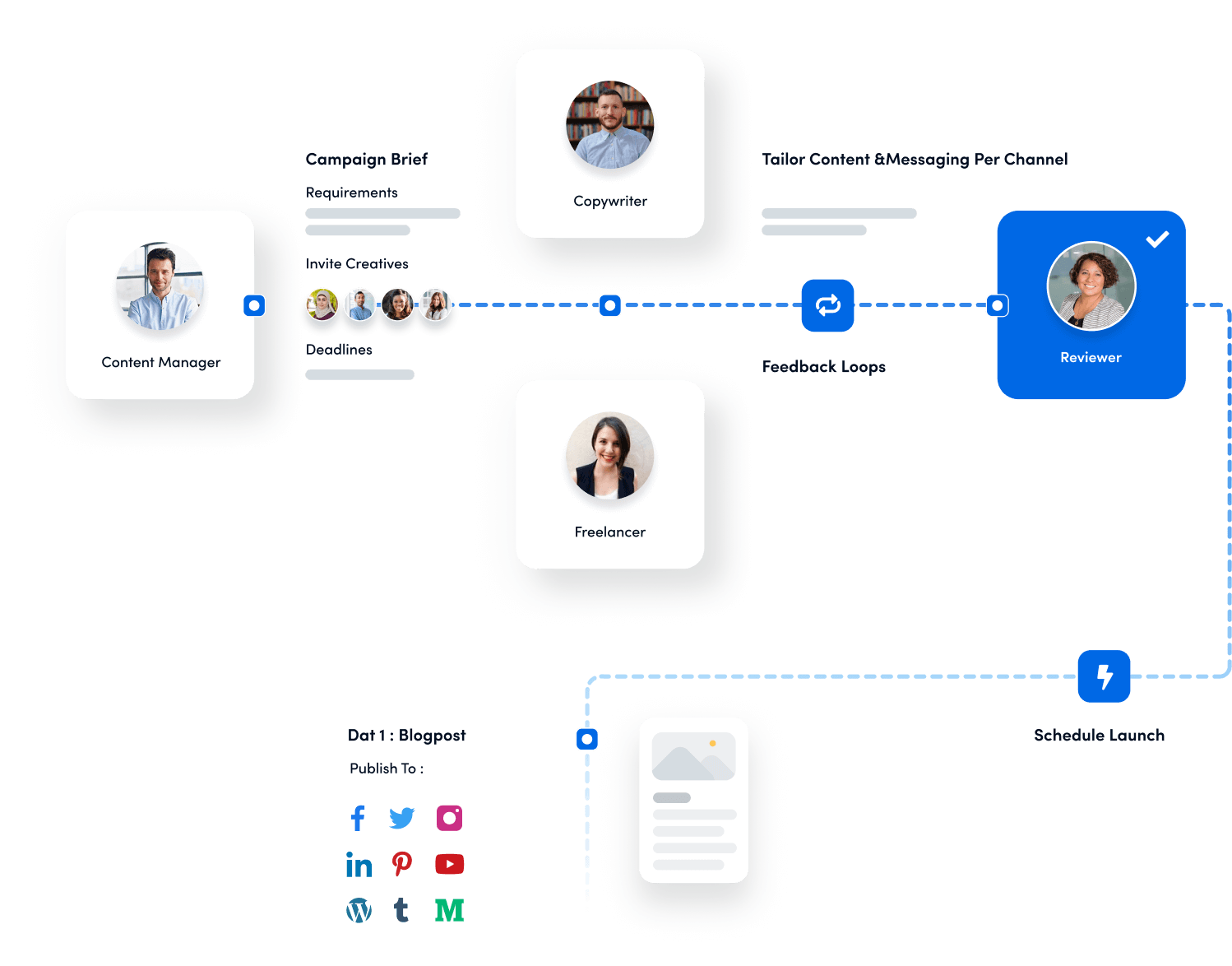

Experience organized workflow with a unified social media management platform for agencies.

Try ContentStudio for FREE

Why do you need a competitive intelligence tool?

Competitive intelligence tools help businesses track competitor moves—like product launches, pricing changes, or new messaging—in real-time. Instead of reacting late, teams can quickly adjust strategies, update campaigns, or prepare sales with the latest information. CI tools also improve decision-making by consolidating timely data on market dynamics, customer sentiment, and competitor performance.

Leaders gain faster visibility into risks and opportunities, replacing guesswork with insight. These tools also identify trends early by monitoring reviews, patents, and hiring signals—helping companies innovate, adapt, or pivot with greater precision. In short, CI tools offer sharper foresight and agility, enabling businesses to act with confidence before competitors do.

Types of competitive intelligence tools

Competitive intelligence tools serve a variety of purposes, from tracking market trends to analyzing competitor traffic. Categorizing them by function helps build a well-rounded toolkit aligned with specific business intelligence needs.

Market research and analysis platforms

Market research and analysis platforms provide market size, trend, and consumer insight data by aggregating reports, statistics, and news—helping businesses understand industry dynamics, key players, and behavior shifts across broad market segments.

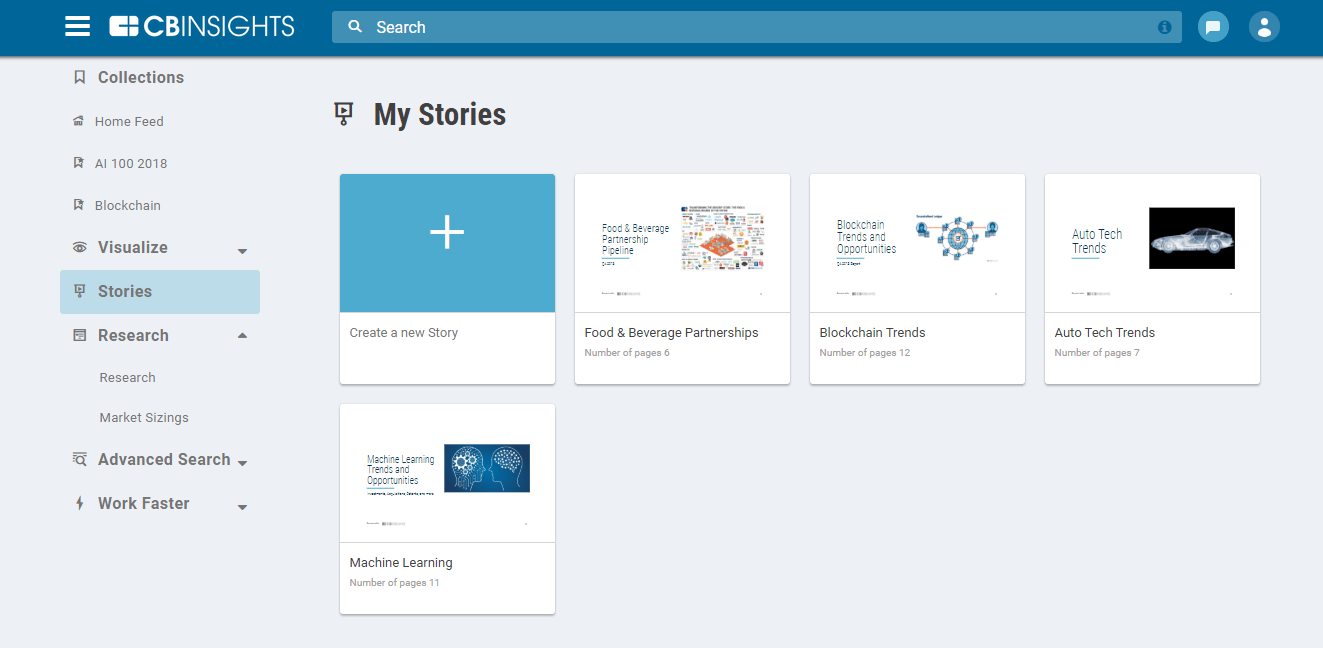

1. CB insights

CB Insights is a top market intelligence platform that tracks startups, tech trends, and industry signals. It analyzes data from investments, news, patents, and earnings calls to surface strategic insights.

Strategy teams use it to identify emerging competitors, monitor innovation, and understand where rivals are investing. Its visual reports and AI-driven analysis help spot market shifts early. CB Insights is widely used to forecast trends and inform forward-looking business decisions.

2. Statista

Statista is an online portal that provides market statistics and consumer survey data on thousands of topics. It compiles information from multiple sources into easy-to-read charts and reports. Users can quickly find insights on market sizes, usage trends, and consumer behavior, supporting competitive analysis.

Many statistics are freely available, while in-depth reports require a subscription. The platform’s interactive tools—like forecasts and country comparisons—make it easier to benchmark markets. Statista is a reliable starting point for strategic, data-driven research.

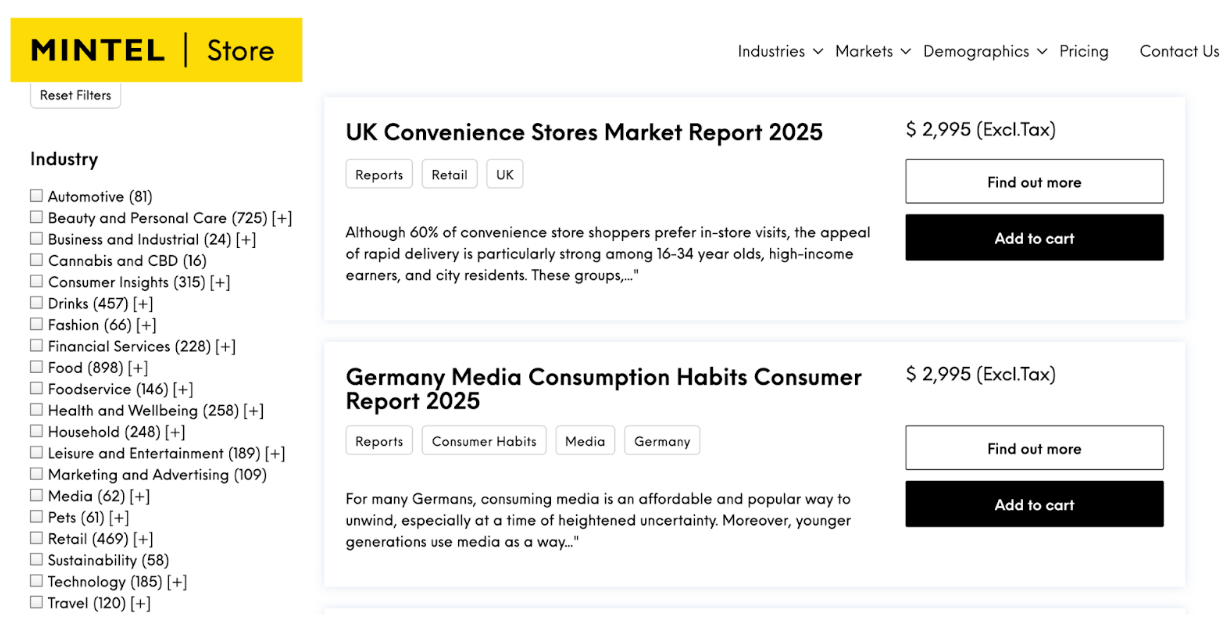

3. Mintel

Mintel provides in-depth market research for consumer sectors like CPG, retail, and finance, offering qualitative insights, trend analysis, and consumer surveys. Businesses use Mintel to explore market trends or assess competitor launches. Reports are available by topic or via custom research.

Similar platforms, such as Euromonitor and GlobalData, offer forecasts and benchmarks that are used in long-term planning. Although subscription-based, these services provide expert analysis that goes beyond what general web searches typically reveal, supporting a deeper understanding of the market and informed strategy.

Social listening and monitoring tools

Social listening and brand monitoring tools track online conversations across various platforms, enabling businesses to capture brand mentions, public sentiment, and competitor trends in real time, thereby staying informed and responding strategically to emerging opportunities or issues.

4. Brandwatch (Cision)

Brandwatch, part of Cision, is a top social listening tool that tracks millions of online conversations. It analyzes brand mentions, sentiment, and trending topics across social and traditional media. Marketing teams use it to monitor competitor campaigns and public reactions.

Features include AI-driven sentiment analysis, logo detection in images, demographic insights, and influencer tracking. Integrated with Cision’s media monitoring, Brandwatch provides a unified view of brand perception, enabling businesses to stay informed and responsive to shifts in public and competitor activity.

5. Talkwalker

Talkwalker offers comprehensive monitoring across social platforms, news websites, blogs, and forums. Its dashboards compare share of voice, sentiment trends, and branded content across channels. Unique capabilities include visual content and podcast audio analysis, letting users catch mentions beyond text.

It also provides e-commerce analytics by tracking product reviews on platforms such as Amazon. It offers AI-driven trend forecasting to help businesses anticipate which hashtags or topics are likely to go viral. For CI, it delivers a detailed view of brand perception and alerts users to shifts in sentiment.

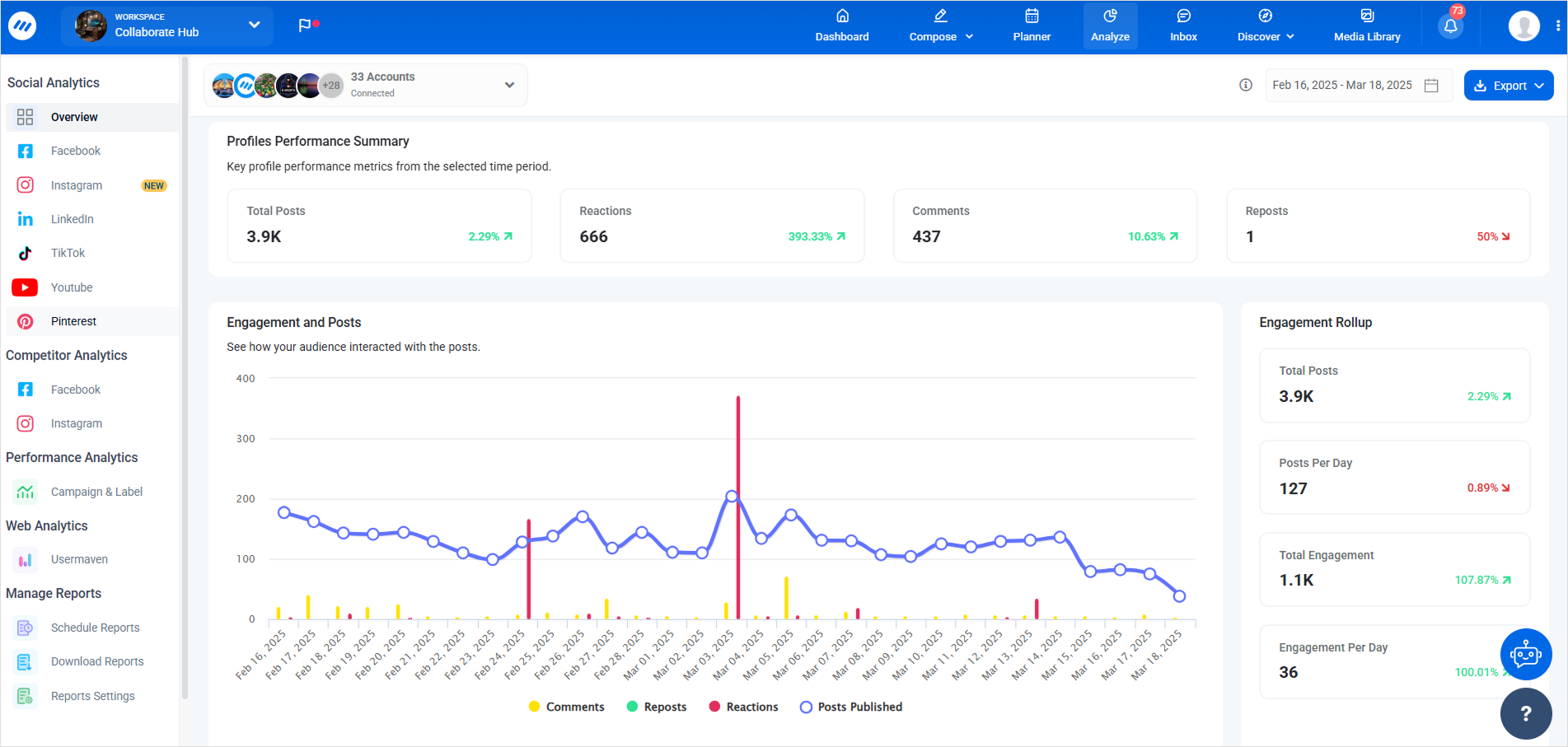

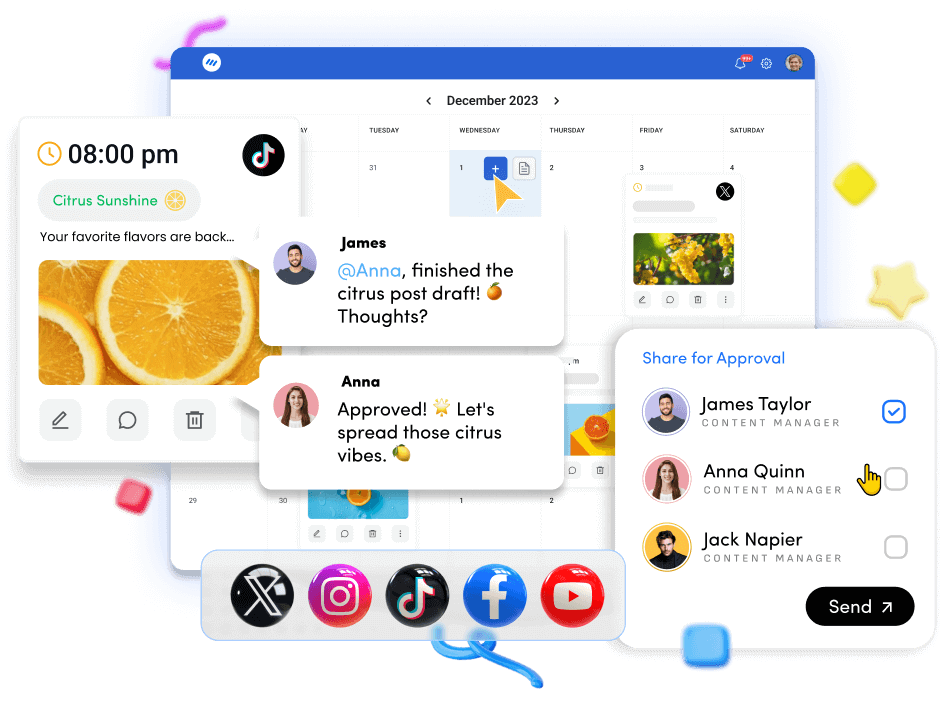

6. ContentStudio

ContentStudio is a social media management platform with added value for CI. It enables the tracking of competitors’ social media accounts, industry-specific keywords, and content engagement metrics. Social managers use it to discover which posts, videos, or articles tied to competitors are trending.

It highlights high-performing content and engagement patterns, showing what resonates with target audiences. The platform features advanced social listening streams and an AI writing assistant, combining publishing and monitoring capabilities that are particularly useful for smaller teams seeking insight into competitor content strategies.

SEO and keyword intelligence software

SEO and keyword intelligence tools reveal which keywords drive traffic to competitor sites, how they rank on search engines, and where opportunities exist to improve visibility and outperform them in organic and paid search.

7. Semrush

Semrush is best known as an SEO platform, but its competitive intelligence capabilities extend far beyond search optimization. It offers deep insights into a competitor’s online presence, including social media traffic sources, ad campaigns, and keyword rankings. The Traffic Analytics tool estimates website visits and engagement, allowing side-by-side comparisons across competitors.

Users can pinpoint when a traffic spike occurred, identify the channels responsible, and determine which content or campaign drove the results. Semrush also reveals which keywords competitors rank for, helping identify high-value gaps. Features such as real-time tracking of website changes, product updates, and battle card creation support broader market intelligence needs alongside SEO. As of 2025, over 40% of Fortune 500 firms reportedly use Semrush.

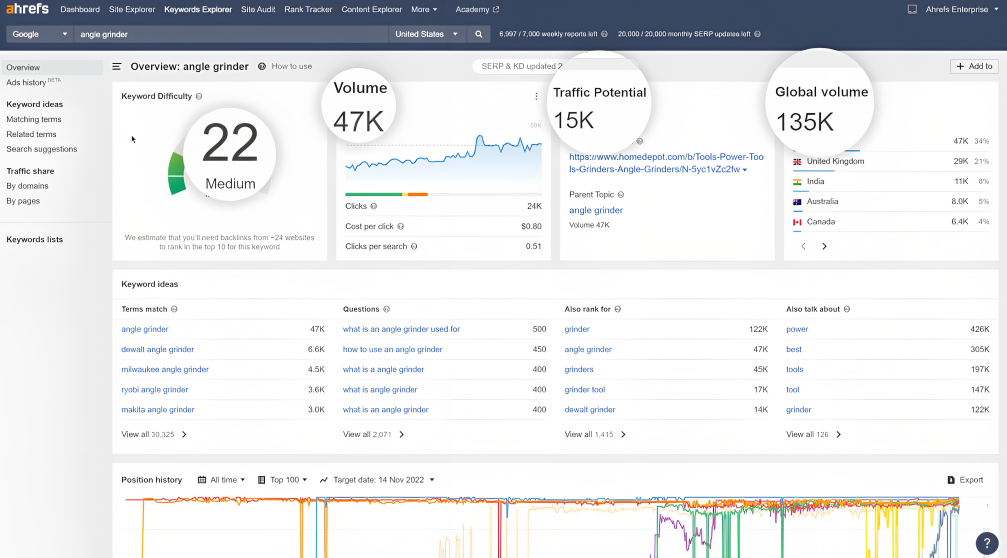

8. Ahrefs

Ahrefs is a powerful marketing platform that helps businesses track and improve their online presence. With one of the largest databases for keywords and backlinks, it’s an ideal tool for analyzing competitors, understanding market trends, and refining content strategies.

Users can discover top-performing content from competitors, identify valuable backlinks, and assess shared keywords across domains. Ahrefs also offers features like keyword gap analysis and Content Explorer, which help identify the most linked or shared content across various topics. Widely used for competitive intelligence, Ahrefs provides marketers with comprehensive insights to optimize campaigns, discover new opportunities, and enhance brand visibility online.

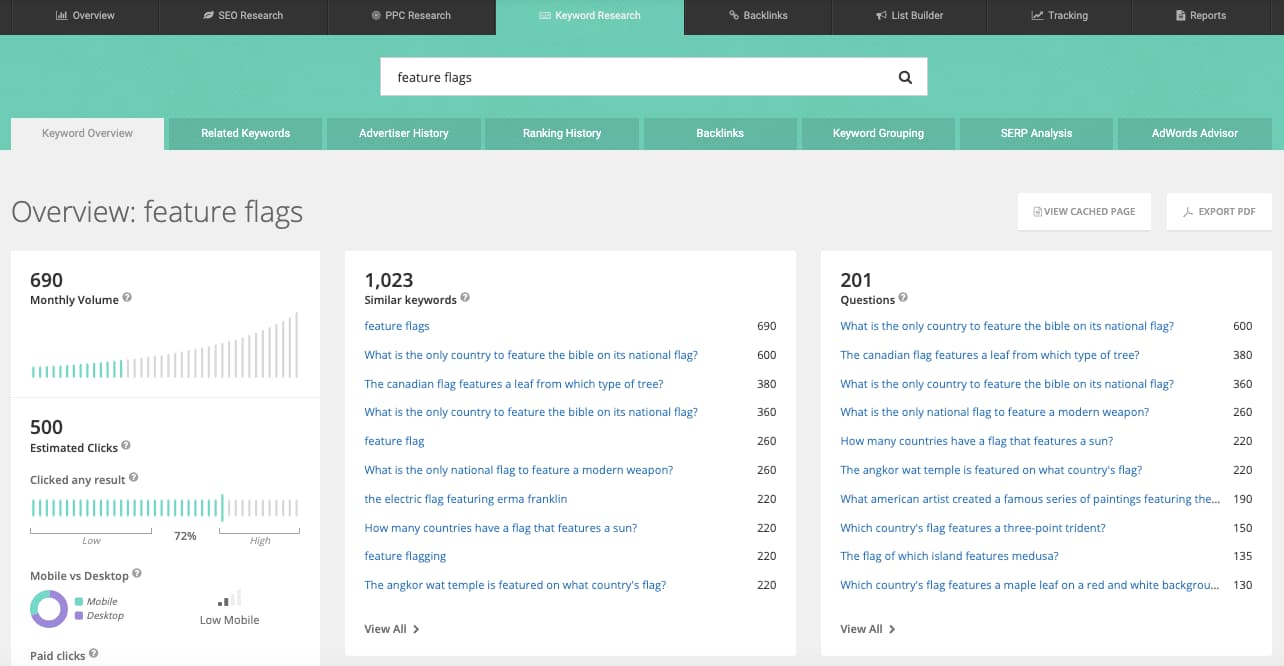

9. SpyFu

SpyFu focuses on uncovering competitors’ paid and organic search strategies. By entering a domain, users can access details on the competitor’s Google Ads campaigns, including keywords, ad copy, and estimated budget. SpyFu also displays SEO keyword rankings and their corresponding movements. Its “Kombat” feature compares keyword sets between multiple competitors to highlight overlaps and gaps.

For instance, if two rivals rank for a term you don’t, it flags a missed opportunity. SpyFu includes international market coverage and provides access to over 15 years of historical keyword data, offering valuable insight into long-term shifts in competitor strategy.

Web traffic analysis and benchmarking tools

Web traffic analysis tools reveal how competitor websites perform, where traffic originates, and how audiences interact. These insights support digital strategy, uncover growth opportunities, and help benchmark your performance against competitors to refine marketing and content efforts.

10. Usermaven

Usermaven is a privacy-focused analytics platform that helps businesses understand user behavior, product engagement, and marketing performance without relying on cookies. Designed with GDPR and privacy compliance in mind, it provides accurate insights while respecting user data.

Usermaven provides real-time dashboards, event tracking, funnel analysis, and campaign attribution to enable SaaS companies and marketers to make informed, data-driven decisions. Its lightweight script ensures fast page loads and seamless performance.

With a user-friendly interface and clear visualizations, Usermaven simplifies complex data, enabling teams to uncover trends, optimize user journeys, and drive growth—all while maintaining transparency and trust with their audience.

11. Similarweb

Similarweb is a web traffic analysis tool that offers insights into site performance and user behavior. It provides metrics like unique visits, bounce rates, visit duration, and traffic sources. Businesses use it to benchmark competitor sites and track changes in traffic patterns.

If a competitor’s traffic spikes, Similarweb can reveal if it was due to ads, search visibility, or referrals. Its AI-driven insights and enhanced datasets help users detect sudden changes and uncover traffic sources that impact market share.

12. Google Analytics

Google Analytics offers benchmarking by comparing site metrics against anonymized industry averages for opted-in users. While it doesn’t provide competitor data, it helps assess performance in a contextual manner.

For deeper insights, tools like Matomo or Open Web Analytics offer self-hosted, customizable options with better integration. Some companies also utilize panel-based or ISP-level data sources for more direct insights into competitor behavior. These alternatives help close gaps left by GA’s privacy limits, enabling more complete and strategic performance comparisons when combined with internal data.

Product and pricing intelligence solutions

Product and pricing intelligence tools monitor competitor product listings, price shifts, stock levels, and promotions. They help businesses stay informed and responsive, particularly in sectors where pricing decisions have a direct impact on market position, revenue, and customer acquisition.

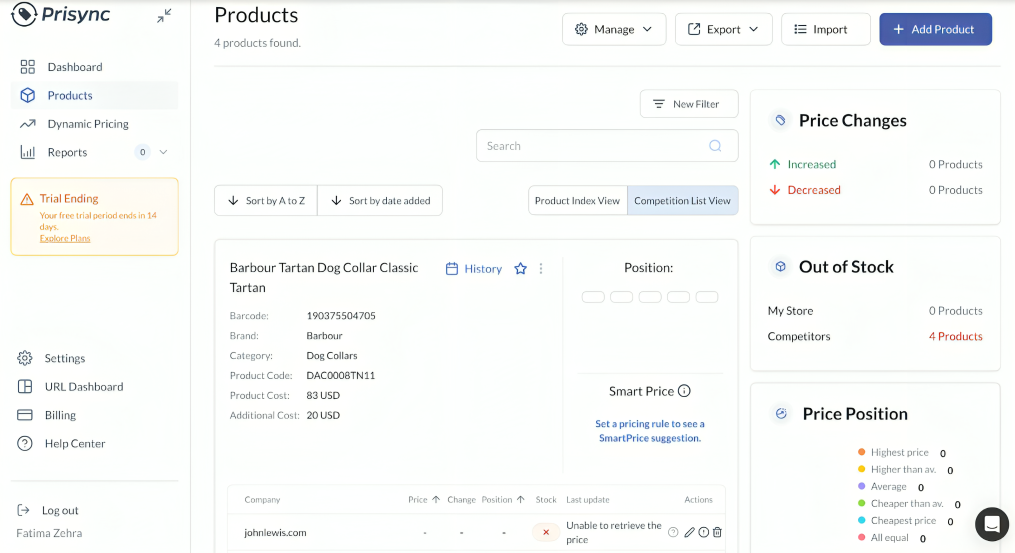

13. Prisync

Prisync automates competitor price tracking across platforms like Amazon and Walmart, delivering real-time updates and instant alerts on price changes. Businesses can react quickly by adjusting pricing or launching promotions.

It tracks historical pricing to uncover trends like seasonal discounts and supports variant tracking for SKUs with different sizes or features. With email and Slack alerts plus AI-powered pricing suggestions, Prisync enables fast, data-driven decisions without requiring manual price monitoring.

14. PriceShape

PriceShape provides pricing recommendations by analyzing market rates and suggesting adjustments to enhance margins without compromising competitiveness. It visualizes pricing trends to highlight anomalies, such as products priced too high or too low.

If a product already leads on price, the tool may suggest a slight increase while maintaining that position. It also supports channel-specific pricing strategies, enabling businesses to remain competitive on marketplaces while maintaining premium pricing on direct sales channels, thereby improving profit control.

15. Zilliant

Zilliant helps B2B companies set optimal prices using analytics based on purchase history, customer segments, and competitor data. It supports scenario planning and delivers recommendations through real-time CRM integration.

The platform ensures consistent pricing across sales channels, whether buyers engage through reps or self-service. By aligning strategy with market shifts, Zilliant enables responsive, margin-conscious decisions. Sales teams can act more quickly and accurately, enhancing both competitiveness and pricing performance in complex B2B environments.

Sales intelligence platforms

Sales intelligence platforms provide company and contact data to support sales efforts. They reveal competitor customer insights, identify new leads, and track organizational changes such as key hires or expansions—offering strategic cues for targeting and account-based selling.

16. ZoomInfo

ZoomInfo is a B2B sales intelligence platform offering company, contact, and tech stack data for targeted outreach. It helps track where competitors are selling and what tools their clients use. Features like “Scoops” reveal expansion signals, while Copilot summarizes updates and drafts messages. Integrated with Salesforce, it delivers insights into daily workflows.

ZoomInfo supports real-time prospecting, enabling sales teams to pitch more effectively and identify opportunities across competitor accounts.

17. LinkedIn sales navigator

LinkedIn sales navigator enhances prospecting by tracking competitor updates, customer shifts, and employee changes. Alerts on leadership moves or new projects help uncover opportunities. Relationship Explorer and account mapping identify shared connections for outreach.

When multiple users at a client update roles or tools, it may signal churn. It also flags funding rounds and hiring spikes, revealing growth activity. Sales Navigator enables daily sales planning with real-time intelligence, helping teams stay competitive and responsive.

18. Apollo.io

Apollo.io blends contact intelligence with outreach automation, making it a strong alternative to tools like ZoomInfo. It provides company and tech install data, helping users identify the tools competitors’ customers use. Sales teams can tailor pitches based on that insight.

The platform supports email sequencing, engagement tracking, and intent data to highlight accounts researching specific tools or competitors. Real-time updates ensure contact information remains accurate, particularly during role changes. Its affordability and ease of use make it popular among smaller teams. Apollo also serves as a valuable second source for verifying competitive data collected from other platforms during sales prospecting.

Patent and innovation tracking tools

Patent and innovation tracking tools monitor patents, scientific publications, and related signals to reveal competitors’ R&D focus. They offer insights into future developments and are especially valuable in industries where intellectual property plays a significant role in shaping long-term strategic advantage.

19. PatSnap

PatSnap aggregates patent data, R&D filings, and startup activity into a single platform for innovation tracking. Users can search for patents by competitor, analyze shifts in R&D focus, and identify potential technology partners. The platform visualizes activity across key domains, enabling the identification of new entrants or emerging threats.

AI-powered clustering and summarization simplify the analysis of large patent sets. Its Innovation Graph links patents to scientific papers and funding data, signaling momentum behind technologies. A spike in filings or investments can indicate upcoming product launches. The Innovation Score quantifies a company’s innovation strength, helping teams benchmark and track competitive R&D efforts more effectively.

20. Clarivate Derwent

Questel’s Orbit Intelligence provides comprehensive patent tracking across jurisdictions, making it a valuable resource for companies operating in multiple markets. The platform enables direct comparison of competitors’ patent portfolios by volume, technology, and legal status.

Users can identify global trends, abandoned patents, and emerging opportunities. Its scientific literature module links patents to academic research, allowing early detection of innovation signals before formal filings. If a competitor publishes a paper on a new material, Orbit flags it as a potential development. Legal status tracking also reveals how actively a competitor defends its intellectual property, offering insight into possible legal risks or strategic changes.

21. Questel Orbit Intelligence

Questel’s Orbit Intelligence provides patent monitoring across jurisdictions, enabling companies to compare competitors’ portfolios by volume, technology area, and legal status. It tracks global trends, identifies gaps, and reveals abandoned patents.

Its scientific literature module links patents with academic research, flagging early R&D signals before they are filed. When a competitor’s team publishes new materials, Orbit marks it as a potential innovation cue. Legal status tracking helps assess how actively a competitor protects its intellectual property (IP), signaling potential legal risks or strategic shifts.

News monitoring and media intelligence software

News monitoring and media intelligence tools aggregate and analyze the vast amount of news articles, press releases, and media mentions that can contain valuable competitive insights. These tools help you stay informed about key developments in the market, including competitor activities, industry changes, and public narratives that may impact your business.

22. Meltwater

Meltwater is a media intelligence platform that tracks global news, social media, blogs, print, and broadcast sources across various platforms. It enables companies to track every public mention of competitors or industry terms across a broad range of media outlets. If a competitor is featured in a regional trade journal or international press release, Meltwater captures it.

Users can analyze trends in media coverage, including volume and sentiment, to gain insights into the overall tone and direction of the coverage. The platform features GPT-powered summaries that condense ongoing news into concise, actionable briefings, along with sentiment indicators that highlight which topics are driving positive or negative coverage.

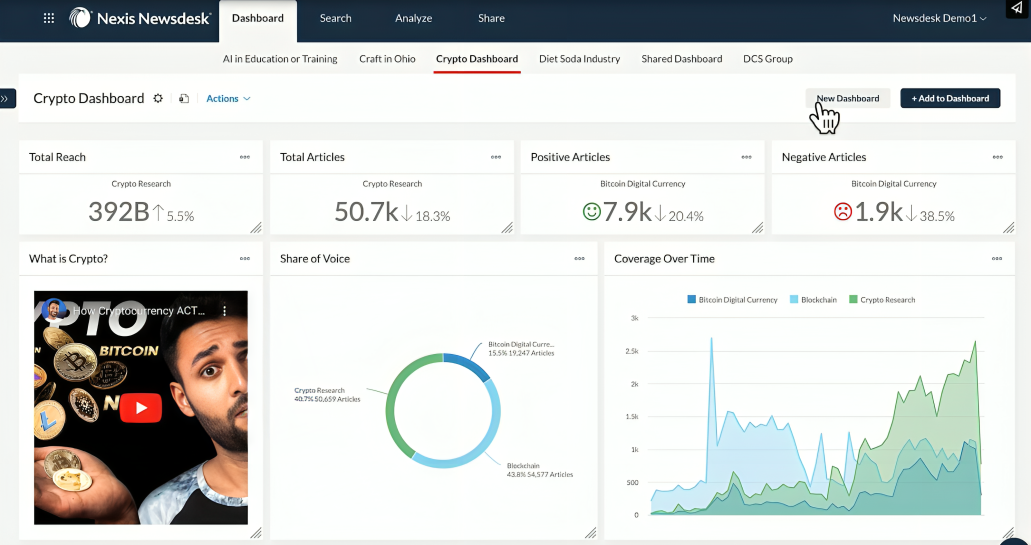

23. Factiva and Nexis Newsdesk

Factiva and LexisNexis Newsdesk are trusted platforms for news research and competitor monitoring, offering access to thousands of sources, including paywalled media. Newsdesk provides real-time alerts and visual trend tools for quick analysis. Both platforms are effective for tracking regional or niche media coverage often overlooked by other tools. Though they lack advanced AI features, their strength lies in delivering reliable, in-depth insights on how competitors are represented across various markets and over time.

How to choose the right competitive intelligence tools

Choosing the right CI tool requires more than feature comparison. Evaluate alignment with business goals, workflows, and strategy using clear criteria to ensure long-term value and practical integration.

Data coverage & relevance

Verify that the CI tool offers access to the data types your business requires, such as reviews, pricing, patents, or filings. Define your priorities and ensure the tool covers those sources. A reliable CI tool centralizes competitive intelligence sources into a single hub, reducing blind spots and enabling faster, more informed decision-making.

Ease of use & workflow integration

A strong CI tool should simplify insight gathering and sharing, offering easy navigation and minimal training requirements. Seamless integration with social media management tools, such as Slack or Teams, ensures alerts fit into existing workflows. During trials, test how easily insights are extracted. The right tool streamlines reporting and helps teams act faster.

Credibility and data quality

A CI tool is only as valuable as its data quality and reliability. Trustworthy platforms clearly cite their sources and offer security measures, such as encryption and access controls. Transparency around AI usage is essential; users should know how insights are generated. Check reviews for reliability before choosing a platform.

Features & customization

Look for modular features and flexibility to suit the different needs of your team. Core functions, such as tracking, alerts, and dashboards, must be customizable for various content marketing roles. The platform should support role-based access and adjustable notifications. Ensure the tool can handle growth without added complexity.

Cost, ROI & vendor support

Evaluate if the features, time savings, and insight quality justify the cost. Track improvements in decision speed and strategic clarity. Strong vendor support is essential—look for responsive service and regular updates. Select tools that deliver a return on investment (ROI) and support the integration of long-term content strategies.

Benefits of using competitive intelligence tools

Competitive intelligence tools support better decision-making across business functions by transforming how teams gather, analyze, and act on external information.

Proactive strategy and no surprises

CI tools enable teams to shift from reacting to planning ahead by monitoring markets and competitors in real time. Early alerts improve campaign timing, product launches, and content planning. Rather than scrambling after news breaks, teams stay ready to make deliberate, confident moves.

Better product development and innovation

CI tools help product teams identify what competitors offer and where they fall short in their offerings. By analyzing reviews, they can spot commonly requested features. Market research, including patent tracking and press releases, reveals competitor R&D focus, enabling teams to identify areas for differentiation.

Enhanced sales and marketing effectiveness

Sales and marketing teams perform better with real-time insight into competitor messaging and positioning. CI tools help create battle cards, refine outreach strategies, and identify content gaps. These insights enable targeted campaigns, shorten sales cycles, and improve win rates.

Improved operational efficiency and focus

CI tools automate data gathering, organize updates, and prioritize relevant insights. Centralized dashboards reduce information silos, speed up access to intelligence, and minimize repetitive tasks. Many companies report finding strategic insights much faster after adopting content intelligence tools.

Risk mitigation and informed decision-making

CI tools provide external context for significant decisions, helping assess competitor strategies, market saturation, and regulatory risks. Ongoing trend monitoring reveals disruptions early, giving teams time to adjust. Businesses using CI tools report faster, more accurate decision-making than those relying on instinct alone.

Future trends in competitive intelligence tools

Competitive intelligence tools are evolving to meet changing business needs and growing demand for real-time, predictive insights.

AI and machine learning transforming CI

AI is reshaping CI tools through automation and improved analysis speed. Natural language processing summarizes competitor updates, while machine learning detects patterns and forecasts strategy shifts. Many teams now use AI content tools to draft summaries and battle cards, increasing efficiency while ensuring accuracy.

Real-time and continuous intelligence

Real-time dashboards have replaced periodic reports. CI tools now offer hourly monitoring, predictive alerts, and mobile access. Many platforms integrate with communication tools, enabling intelligence to be pushed directly to decision-makers, resulting in faster business decisions at every level.

Predictive and prescriptive analytics

CI tools are shifting from backward-looking analysis to forecasting and strategy recommendations. Historical trends, competitor behavior, and market signals feed algorithms that forecast product launches or price changes. This trend brings CI tools closer to becoming full decision support systems.

Integration and collaboration in workflows

CI tools now integrate with CRM, communication apps, and business intelligence platforms. Intelligence is distributed across teams rather than siloed with analysts. Workflow collaboration ensures CI insights are visible and actionable through content collaboration.

Expanded coverage: SMEs, niche data, and global reach

More CI tools target SMEs with scaled-down pricing and broader features. Vendors are adding niche data types, such as geolocation tracking and job postings. Tools now support regional content, local languages, and sector-specific modules, making CI more affordable, specialized, and globally connected for digital marketing teams.

The easiest way to manage and grow your social channels.

Try ContentStudio for FREE

Conclusion

Behind every successful strategy lies a team that truly understands the competitive landscape. Competitive intelligence isn’t just about fancy dashboards—it’s about giving people the confidence to make bold moves in crowded markets.

Gone are the days of manually tracking competitor updates. What matters is how these tools transform real decisions: sales reps nailing pitches, product managers prioritizing the right features, and CMOs repositioning brands ahead of market shifts.

Select tools that align with your team’s workflow. The best solution isn’t the one with the most features but the one your people will use daily to outsmart the competition.

When you truly understand your market, you don’t just react to change—you create it.

Frequently asked questions

What is competitive intelligence, and how is it different from business intelligence?

Competitive intelligence involves monitoring competitors, market trends, and external signals to inform strategic decisions. Business intelligence, by contrast, analyzes internal data, such as sales or operations. CI looks outward to guide competitive positioning, while BI looks inward to improve performance.

Are competitive intelligence tools legal and ethical to use?

Yes, CI tools are legal when they rely on publicly available or licensed sources, such as websites, news, and social media platforms. Ethical CI avoids hacking and confidential data breaches, focusing solely on open-source intelligence and adhering to professional conduct standards.

How often should we update or conduct competitive intelligence?

CI should be continuous. Real-time tools enable constant tracking but at a minimum, review competitor updates monthly. In fast-moving industries, weekly or daily monitoring may be necessary to catch shifts early and respond effectively with informed decisions.

Can small businesses benefit from competitive intelligence tools?

Yes, small businesses can use affordable or free CI tools to track competitors and uncover market opportunities. Even fundamental insights can help inform adjustments to pricing, messaging, or product features. CI enables faster decisions without large budgets, offering a strategic edge.

Recommended for you

Powerful social media management software

14-day free trial - No credit card required.